- Introduction

- Changes to EU VAT rules and IOSS – affecting low-value orders

- EORI number

- Commodity HS codes

- Government £20m SME Brexit Support Fund

- UK Transition out of the EU

- Working with your Network

- Trading with Northern Ireland

- Protecting your designs

- Impact on Overseas Recruitment

- Department of International Trade Levelling up Regions

- Further Information

Last updated 31st August 2022:

Introduction

As part of our support to GCA members we are working to help you navigate the Brexit maze by picking out salient links and points relevant to the greeting card industry.

EU VAT is an ongoing issue, with many of you telling us that you have stopped selling direct to consumers in the EU. Two pieces of important information on this issue:

Firstly, there is now a simple cost-effective solution to access IOSS and pay EU VAT being using by a number of GCA members. This was developed by Mathew O’Marah, of Dean Morris Cards, see below for details.

Secondly, thank you very much to those of you who completed the survey we pulled together with our Indie Retail friends. The results of this clearly demonstrated the affect of this issue for small businesses: 46% of those responding to the survey have now completely stopped selling into the EU. 86% of these were selling less than £125k a year into the EU, which for 89% of the businesses completing the survey accounted for less than 25% of their total sales (for 61% less than 10%). The full results of survey were shared with Small Businesses Minister Paul Scully.

Please find below the top-line information on trading internationally post-Brexit. There is more detailed information in the Members’ Library, and links to further information below.

Changes to EU VAT rules and IOSS – affecting low-value orders

Until July 2021 EU and non-EU sellers selling goods online to EU consumers could import the goods into the EU, directly to the consumer, importing VAT-free if the order was valued at €22 or below. This ended in July 2021 and all imports will be subject to EU VAT in the relevant country of import, a challenge for most small businesses.

For consignments with a value of less than £150 the VAT will be charged at the point of sale, rather than at the point of arrival in the customer country. To help simplify this process UK-based businesses can register for Import One-Stop Shop (IOSS) as ‘non-Union sellers’.

IOSS is designed to help small traders selling goods directly to consumers. Using IOSS will require VAT registration in just one EU member state, rather than each individual country sales are made in. A business registering for the IOSS will receive a unique number that must be quoted on all shipments to the EU. A single IOSS VAT return will then be filed monthly to declare all import VAT due. UK companies wanting to register for IOSS will need to appoint an EU intermediary from July 1st, this is proving cost-prohibitive for many small businesses as the monthly costs associated with paying the VAT outweigh the sales.

Low-cost solution available for GCA members

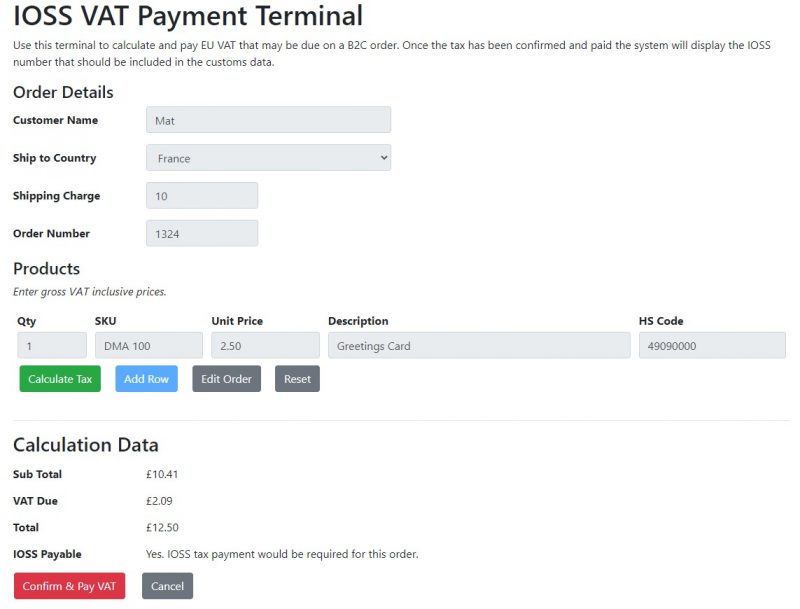

Mat’s solution is simple, and the only charge is when you make a sale: The IOSS VAT Terminal allows you to make EU Order VAT payments quickly and easily without having to integrate into your website or pay an expensive fixed monthly management fee. It is an online service you login to each time you have an EU order. Once setup you enter basic order details (order value, shipping cost and product list) and the Terminal calculates any VAT due and allows you to pay it directly to the EU. This then gives you an IOSS number for customs data so that your orders can be delivered duty paid, avoiding delays and additional charges a customer may face. For more information, including a short video, and to contact Mat visit the demo site https://www.iossvat.com/

The system makes use of the Taxamo Assure platform, where you pay the VAT due and £2.00 per order processed. So you are only paying when you have orders to send, and most companies are now including all or part of the £2.00 fee within the shipping costs to reduce losses and to ensure they are still able to supply their European customers.

Background on the EU VAT Changes

This issue was highlighted by GCA members earlier in the year, the GCA met with small businesses Minister Paul Scully MP on 2nd June 2021 and highlight these challenges. GCA ceo, Amanda Fergusson explained that “….while there was general understanding of the rationale behind these changes, the uncertainly and looming costs associated with the IOSS solution is putting small businesses off exporting low value items like greeting cards”.

The Minister thanked the GCA for raising and said that this was affecting EU traders too. He assured the meeting, attended by other trade associations connected with independent retailers, that the issue was the subject of discussion at the regular ’round-table’ meetings held with the Department of International Trade including the negotiations team. He said that the government was working hard to “issue clear guidance well before the 1st July date”.

The GCA covered ISSO in detail at our 2nd GCA Panel Discussion at the end of April 2021, it was also covered by the Financial Times on 20th and 21st May 2021, in an article that quoted GCA CEO Amanda Fergusson and GCA member David Falkner from Cardology.

One of the questions still not fully resolved is about the need for an intermediary to assist with IOSS. Due to the UK-EU mutual assistance protocol, UK businesses should not need an intermediary. However, although mutual assistance has been agreed between the EU and UK, this in practice is not yet fully in play, which means that UK companies wanting to register for IOSS may need to appoint an intermediary from July 1st until this is sorted. If this does happen there are companies that can offer in-house Fiscal Representation services – all will carry additional, as yet undefined, costs. Avalara, who joined our Panel Discussion, are one such company.

Many businesses are looking at how they can support customers through this process:

This clear guide from UPS explains the situation and offers various routes.

FedEx announced in May 2021 that they are working with KPMG on a bespoke IOSS VAT compliance process Changes to EU VAT Rules | FedEx United Kingdom

The GCA met with the Royal Mail in May 2021, who are looking at a Delivered Duty Paid option, see Delivered Duties Paid (DDP) and Import One Stop Shop (IOSS) | Royal Mail Group Ltd. Note if you are shipping via the Post Office they do not expect to have a solution to be able to record and transmit the IOSS number live from the 1st July, however they are looking at what can be done. In the meantime they ask customers to use the Royal Mail online shipping channels, see link above which will be regularly updated.

Online marketplaces are also contacting customers to explain how they are handling this – do look out for information from any you list your designs on.

The GCA are in touch with the Department of International Trade and will continue to update this blog as more information is received. In the meantime if you have questions or would like to get in touch with other GCA members navigating these waters please contact us.

EORI number

An Economic Operators Registration and Identification number (EORI number) is a method for tracking products being traded to and from the EU so shipments can be identified by customs. The EORI number consists of the country code and up to 15 digits. If you are VAT registered, your EORI number will consist of the prefix ‘GB’ followed by your VAT number, and suffixed with ‘000.’ However note that you may need a different one for Northern Ireland (see below).

You will need an EORI number if you sell cards to any other country outside Great Britain (England, Scotland and Wales), including Northern Ireland.

If you are trading outside the UK for the first time you will need to apply through HMRC for your EORI number to be activated, this should take about 3 working days to process.

To apply for an EORI number, complete an online form that’s submitted to HMRC using your Government Gateway account. Businesses can also contact the HMRC EORI Team on 0300 322 7067.

If you are VAT registered complete the form for VAT registered applicants,

If you are not VAT registered a non VAT registered from if exporting or a non VAT registered form if importing.

Commodity HS codes

The Commodity, or HS, code is a number allocated to classify goods crossing boarders. From January 2021 these codes need to be specified on all goods moving in or out of the UK to the EU. This commodity code dictates the duty rating as well as alerts you to any import or export restrictions.

Key Heading codes for our industry,:

Paper Greeting Cards 490900

Paper Gift Wrap 481190

Paper Gift Bags 481940

Notebooks 4820

The Commodity code for importing greeting cards is a ten-digit number, 4909000000, for exporting greeting cards the number is eight-digits: 49090000.

More guidance on these codes can be found here on gov.uk

GCA Panel Discussions

In April 2021 the GCA held a 2nd Panel Discussion, discussing the current export issues affecting members and answering your queries. Our Panel included Richard Asquith, VP, Global Indirect Tax at Avalara, who spoke in detail about export VAT and responded to questions on IOSS (see below). Emily Lambert, from the Department for International Trade, along with Tom Dixon, an E-commerce Specialist, also from the Department for International Trade, who offered advise on selling online overseas. They were joined by experienced industry exporters: John Welsh – founder of 2WL, industry logistics experts and GCA Supplier Members, Daniel Prince, MD of Danilo and GCA Council Member, David Falkner, Director of Cardology, and GCA Member.

To see this 2nd GCA Panel Discussion click here.

The issue we raised in this Panel Discussion, concerning low-value orders to the EU, was subsequently picked up by the Financial Times on 20th May 2021

The GCA also attended a BEIS Post Transition Forum on 28th April, which included more information on trading with Northern Ireland, see update below.

The 1st Brexit Panel discussion, held in February 2021, focused on trading with Northern Ireland and initial post-Brexit trading issues.

Government £20m SME Brexit Support Fund

The Brexit Support Fund, which allows small businesses to claim up to £2,000 each to get professional advice, is due to close on 30 June 2021 .

Eligibility: SME’s who trade only with the EU, and are therefore new to importing and exporting processes, can apply for grants of up to £2,000, to pay for practical support including training and professional advice to ensure they can continue trading effectively with the EU. See is my organisation eligible for more information.

For more information on the SME Brexit Support Fund, click here and visit Gov.uk. Full guidance on how you can use the grant, who can apply and how to apply, click here.

For a list of customs training providers who provide training courses which will help you submit customs declarations

UK Transition out of the EU

Discussions with Europe resulted in The Trade and Cooperation Agreement on 24th December 2020. There is now confirmation that greeting cards, under tariff code 4909, won’t be subject to additional tariffs. See guidance on Rules of Origin which explains what businesses need to do to ensure that they pay zero tariffs, this applies to both exporting goods to the EU, as well as importing goods from EU. Note the Rule of Origin rules also apply to goods imported from the Far East and sold in Europe, for more information EU UK Trade Agreement, to check other products/countries use EU access to market

All the latest information for business, and travel, to the EU is available on gov.transition , which includes a Brexit Checker to help you find answers relating to specific trading questions. Click the following links for more detail for exporting to the EU or importing from the EU .

The government have created a new forum specifically designed to help businesses and traders find answers to questions regarding the transition period. Any publisher or retailer can post on this platform and get a direct response from the government.

Please note that now the UK is no longer in the EU any trade with Europe will require more paperwork, see Working with your Network below. Do make sure you have an EORI number and the right commodity codes, and if you do see if you are eligible for the Small Business Support Grant.

Working with your Network

The key to successfully navigating trade post-Brexit is to work closely with the businesses you trade with, in many cases the couriers are a good starting point as they will need to have the paperwork completed correctly to successfully transport goods: This FEDEX link outlines suggested preparations, and includes a webinar about cross border shipping which may be useful.

Speak to your own couriers, and others in your supply chain, to ensure that you understand the information they need and are prepared to supply it.

The government has a list of recommended customs agents, including freight forwarders, shipping companies and fast parcel couriers and specialist agents, see this link

Trading with Northern Ireland

The government launched a new UK Trader Support Scheme (UKTS) on 14 December 2020. This scheme will help ensure traders don’t pay tariffs on the movement of goods into Northern Ireland from Great Britain where those goods remain in the UK’s customs territory, you can register with this scheme on this link. There is specific legislation for trading in Northern Ireland, see this government page. For further reading on the Northern Ireland Protocol, see these links, and updates.

There is further help available on the Northern Ireland business explainer which can be found here on gov.uk. This includes information shared with the GCA at a BEIS Post Transition Forum on 28th April 2021.

To move goods between Great Britain (England, Scotland and Wales) and other parts of the UK and overseas you need to get an EOIR number starting with GB. Note that you may need an additional EOIR number to trade with Northern Ireland, starting with XI, to get an EORI number that starts with XI you must already have an EORI number that starts with GB.

Protecting your designs

January 2021 will bring changes to Intellectual Property rights. Please see article, by specialist legal firm Briffa, detailing the key issues for greeting card publishers:https://www.gca.cards/brexit-and-changes-to-intellectual-property/

Impact on Overseas Recruitment

Brexit ended freedom of movement between the UK and EU, with the UK introducing an immigration system meaning that businesses who want to recruit or employ a workforce from outside the UK, will need to ensure that their applicants meet certain requirements and have permission to work and live in the UK.

If you have staff members from EU countries, or are looking to recruit overseas nationals from January 2021, see our down loads below for more information: Steeles Law Employment Q&A offers guidance to ensure compliance with the new visa regulations, and responds to the most frequently asked questions. Hallidays HR have a summary of the information you should consider with further links. If you need assistance do contact Steeles or Hallidays , who both offer GCA members special rates. There is also more information on gov.uk .

Department of International Trade Levelling up Regions

The Department of International Trade is a key contact for any business involved in international trade (see GCA Starting Up – Export blog). Companies in the Levelling Up regions (South West, Midlands, Northern Powerhouse, East of England) can sign up to attend the Export Academy where the DIT covers the following topics:

- Understanding the Benefits and Barriers of Export

- International Market Research

- Customs Procedures and Tariff

- Pricing Strategy and Routes to Market

- Getting Paid

- Incoterms

- Export Controls

- Selling Services Overseas

The sign up for these series is here: www.events.great.gov.uk/exportacademy For more information on this and other questions listen to DIT’s Emily Lambert speak about this, and other help available at the GCA’s April 2021 Panel Discussion.

Further Information

See the GCA Panel Discussions, where we assemble a Panel to discuss the key issues for the greeting card industry and respond to Members’ questions on international trade post-Brexit. These seminars are now available in the Members’ Library, and both contain lots of additional useful links and information specific to our industry. Also see the GCA’s Starting Up – Export blog

The GCA is also attending regular government forums on International Trade Post-Transition. The relevant notes and slides from these are also available in our Members’ Library.

Additional government support:

Department for International Trade’s Check How to Export Goods online tool, where you can find information on the UK border, and duties and customs procedures for over 160 markets around the world.

Department of International Trade Advice pages

VAT guidance about the conditions for zero rating VAT on the goods you export, and what you should do when you export goods in specific circumstances.

HMRC’s Customs & International Trade Helpline which you can call and speak to an advisor on 0300 322 9434. The helpline is open from 8am to 10pm Monday to Friday and from 8am to 4pm at weekends. Or you can send HMRC your questions or use their webchat service.

View the new government on demand videos which focus on priority topics for businesses, such as exporting. These cover 18 topics, including importing and exporting, rules of origin and audit and accounting. Click here to access.

Specific government guidance and training is available on moving goods into, out of, or through Northern Ireland.

For any further queries or general business advice you can contact the government dedicated business support helplines.

Get someone to deal with customs for you – https://www.gov.uk/guidance/appoint-someone-to-deal-with-customs-on-your-behalf

List of customs agents and fast parcel operators – https://www.gov.uk/guidance/list-of-customs-agents-and-fast-parcel-operators

Apply to use simplified procedures (import and export – form C&E48)

https://www.gov.uk/government/publications/import-and-export-simplified-procedures-application-ce48

Customs Freight Simplified Procedures – software providers – https://www.gov.uk/guidance/list-of-software-developers-providing-customs-declaration-support

EU Product standards and requirements

Placing manufactured goods on the EU market – GOV.UK (www.gov.uk)